App Centre

VAT IT Cloud — Expense

Free analysis and easy automated VAT recovery.

By connecting to the VAT Cloud™, you will be able to:

• Unlock cash savings imbedded in your T&E and A/P Expense data.

• Streamline the entire VAT reclaim process with one cloud based solution.

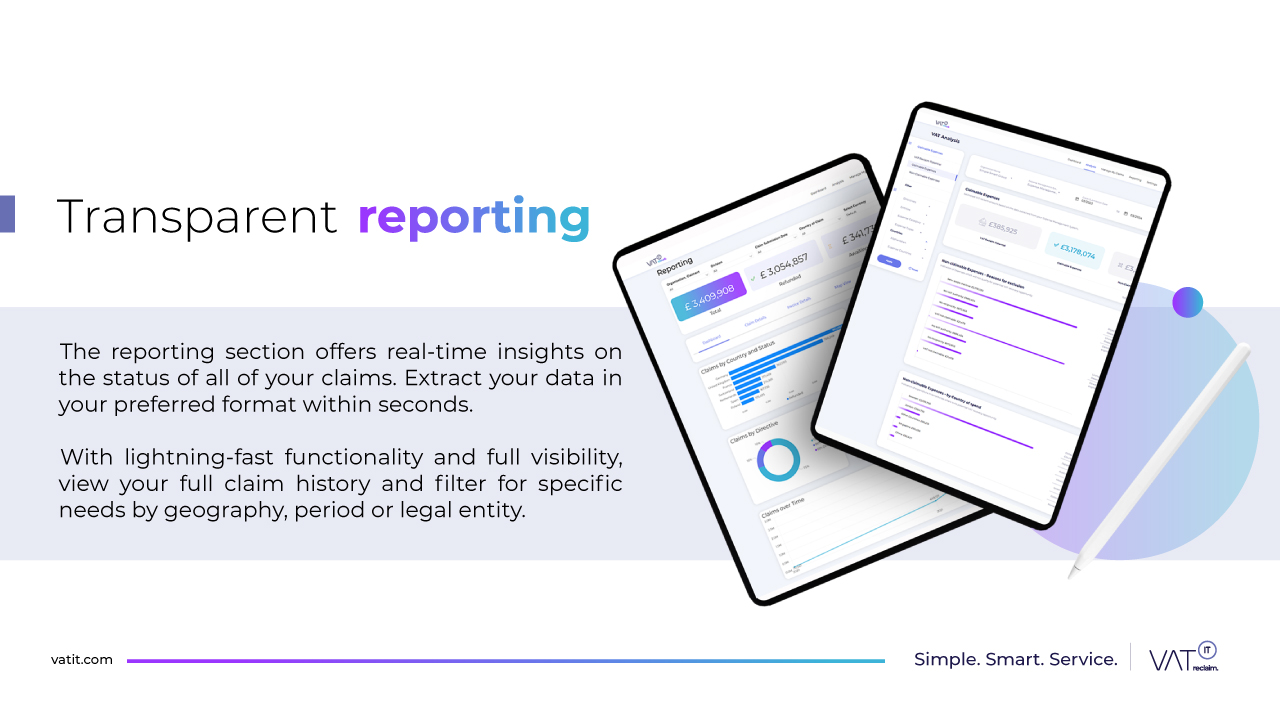

• Clear, transparent reporting on submissions and VAT refunds in real time.

• Overview of expense data by country, expense type and employee.

• Drill down to the finest detail on an invoice level.

• Guaranteed 100% compliant tax refunds.

The Process:

Step 1: VAT Cloud™ extracts data via live system integration with Concur Expense and Invoice. We have the fastest Concur pulling speeds of 86,000 expense entries per hour!

Step 2: VAT Cloud™ algorithms identify all potential VAT reclaims.

Step 3: Decision engine collates expense data and combines them into one record of clean data.

Step 4: Manual Compliance check of every invoice ensures 100% compliancy.

Step 5: Invoices are packaged and collated into compliant VAT reclaim format.

Step 6: Claims are sent directly to the relevant tax office.

Step 7: Watch your VAT savings clock up in your bank account.

About VAT IT:

VAT IT is the world’s leading VAT reclaim agent, helping thousands of companies across the world save costs at the click of a button.

VAT IT has spent the last 16 years identifying, researching and perfecting foreign tax refund opportunities. By letting us do what we do best – tracking down and recovering the VAT you are owed – you can devote your time and resources to running and growing your business.

What VAT IT’s Clients Say About Them:

"The seamless integration of VAT IT with our Concur instance made foreign VAT reclaim pain free." - Sven Ringling, Director, iProCon

“Dedicated, knowledgeable and helpful business partners; VAT CLOUD is very valuable to recover VAT without having to invest a lot of time and money.” – Roland Banholzer, Head of taxation, DHL Express, Inc.

“The only thing I have to do is sign some papers and wait for the money to come in. It works so smoothly.” – Hans Henderrikx, Financial Planning Manager, Tosoh Europe B.V.

“The New York VAT IT team were very patient with us, and did a great job of communicating what needed to be done and following up on deadlines.” – Laurel Fenton, Manager Accounts Payables, Westfield

Works with these SAP Concur solutions:

- Expense - Standard

- Expense - Professional

Regions Available:

- Anguilla

- Antigua And Barbuda

- Aruba

- Bahamas

- Barbados

- Bermuda

- Canada

- Cayman Islands

- Costa Rica

- Dominica

- Dominican Republic

- El Salvador

- Grenada

- Guadeloupe

- Guatemala

- Haiti

- Honduras

- Jamaica

- Martinique

- Mexico

- Montserrat

- Netherlands Antilles

- Nicaragua

- Panama

- Puerto Rico

- Saint Barthélemy

- Saint Kitts and Nevis

- Saint Lucia

- Saint Martin

- Saint Pierre and Miquelon

- Saint Vincent and the Grenadines

- Sao Tome and Principe

- Trinidad and Tobago

- Turks and Caicos Islands

- United States of America

- British Virgin Islands

- Virgin Islands, U.S.

- Argentina

- Belize

- Bolivia

- Brazil

- Chile

- Colombia

- Ecuador

- Falkland Islands (Malvinas)

- French Guiana

- Guyana

- Paraguay

- Peru

- Saint Helena

- South Georgia and the South Sandwich islands

- Suriname

- Uruguay

- Venezuela

- Afghanistan

- Åland Islands

- Albania

- Algeria

- Andorra

- Angola

- Armenia

- Austria

- Azerbaijan

- Bahrain

- Bailiwick of Guernsey

- Belarus

- Belgium

- Benin

- Bosnia and Herzegovina

- Botswana

- Bulgaria

- Burkina Faso

- Burundi

- Cameroon

- Cape Verde

- Central African Republic

- Chad

- Congo, The Democratic Republic of the

- Congo

- Cote D'Ivoire (Ivory Coast)

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Egypt

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- European Union

- Faroe Islands

- Finland

- France

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Holy See (Vatican city state)

- Hungary

- Iceland

- Iraq

- Ireland

- Israel

- Italy

- Jordan

- Kenya

- Kuwait

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macedonia

- Malawi

- Mali

- Malta

- Mauritania

- Mauritius

- Mayotte

- Moldova

- Monaco

- Morocco

- Mozambique

- Namibia

- Netherlands

- Niger

- Nigeria

- Norway

- Oman

- Pakistan

- Poland

- Portugal

- Qatar

- Romania

- Russia

- Serbia

- San Marino

- Saudi Arabia

- Senegal

- Yugoslavia

- Serbia and Montenegro

- Seychelles

- Sierra Leone

- Slovakia

- Slovenia

- Somalia

- South Africa

- South Sudan

- Spain

- Sudan

- Svalbard and Jan Mayen

- Eswatini

- Sweden

- Switzerland

- Tanzania

- Togo

- Tunisia

- Türkiye

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- Yemen

- Zaire

- Zambia

- Zimbabwe

- American Samoa

- Australia

- Bangladesh

- Bhutan

- British Indian Ocean territory

- Brunei

- Cambodia

- Caroline, Mariana, Marshall Is

- Peoples’ Republic of China

- Christmas Island

- Cocos (Keeling) Islands

- Comoros

- Cook Islands

- East Timor

- Federated States of Micronesia

- Fiji

- French Polynesia

- French Southern Territories

- Guam

- Guinea

- Guinea Bissau

- Heard Island and McDonald Islands

- Hong Kong SAR of China

- India

- Indonesia

- Japan

- Johnston Island

- Kazakhstan

- Kiribati

- Korea, South (Republic of Korea)

- Kyrgyzstan

- Laos

- Macau SAR of China

- Madagascar

- Malaysia

- Maldives

- Northern Mariana Islands

- Marshall Islands

- Mongolia

- Myanmar

- Nauru

- Nepal

- New Caledonia

- New Zealand

- Niue

- Norfolk Island

- Palau

- Palestine

- Papua New Guinea

- Philippines

- Pitcairn

- Reunion

- Samoa

- Singapore

- Solomon Islands

- Sri Lanka

- Taiwan of China

- Tajikistan

- Thailand

- Timor-Leste

- Tokelau

- Tonga

- Turkmenistan

- Tuvalu

- USA Minor Outlying Islands

- Uzbekistan

- Vanuatu

- Vietnam

- Wallis And Futuna

- Western Sahara