Employee Experience

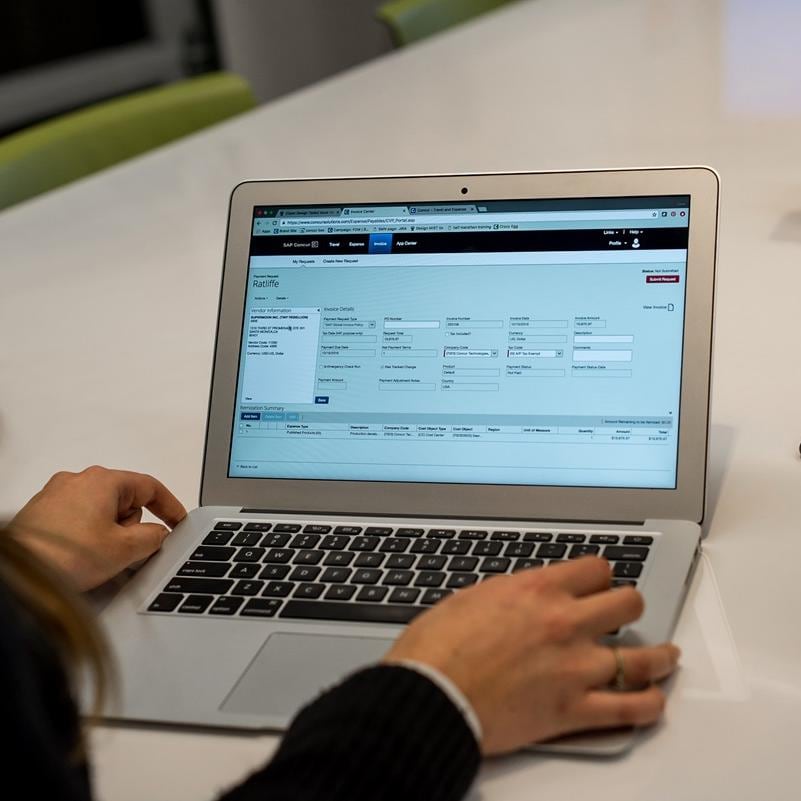

Concur Invoice: Automate accounts payable for a cost-saving, business-boosting centre

Even the best laid spending plans and policies need to be ready to change – and change fast. As we encounter new societal and economic plot twists, CFOs are under increasing pressure to cut costs and be the storyteller of the business. Many are already investing in cutting-edge technology to support agility and flexibility in the face of change – 63% of them in fact, up from 33% in the previous year.

Solutions that automate the invoice process gives finance leaders much-needed visibility into spend. The right solution does more than just alleviate paper-based tasks – it gives finance leaders greater visibility into organisation-wide spend, access to accurate data and improved insights, compliance tools for risk mitigation, and the opportunity to grow and flex as the world shifts.

In this blog we’ll explore the benefits of automating the invoice process and learn how three organisations transformed their accounts payable process (AP) with Concur Invoice.

The CFO role: Risk mitigator, business storyteller, and cost cutter

As organisations continue to innovate, adapt, and grow, AP departments are being challenged to evolve by looking for new ways to create leaner operations, while gaining more control over costs - over half of respondents in the SAP Concur CFO pulse survey say cost control is still a top three internal challenge in 2024.

52 percent of CFOs say that as companies grow, there is risk that costs rise quickly. Even those investing heavily in growth say the risk of runaway costs is still high.

Finance leaders are battling with outdated manual processes and legacy systems that limit decision-making, cash flow visibility, and agility. There’s also the constant struggle to combat fraud and errors that reduce profitability. All of these tasks, if not automated, can lead to employee dissatisfaction and low productivity, with 64% of CFOs naming the automation of mundane tasks as a key benefit of AI.

The good news is technology is an upbeat industry, with 80% of firms putting the ‘tech winter’ behind them and investing in growth. Now is the perfect time to invest in a platform that captures spend across all channels and pushes AI and insight further into and through invoice processes.

Capturing, auditing, routing, approving, and paying vendor invoices is a continued source of strain for businesses of all sizes. Some organisations rely on manual processes to get it done – adding costs, time, and tedious tasks to an already strained workforce.

Does that sound like you?

3 questions every CFO needs to ask about invoice

Before deciding whether invoice automation is the right for your organisation, ask yourself these three important questions:

Concur Invoice solves organisation-wide challenges

CFOs are increasingly seeking closer relationships with HR and IT, with 58% wanting to collaborate with IT in cost control, and 56% in AI initiatives. Concur Invoice supports these goals. With Concur Invoice, you get intelligent tools that automate the AP process – from capturing paper, PDF, and fax-based invoices to making every payment on time.

46 percent of CFOs say integration is a problem with cost control software while 34% say lack of data visibility is a challenge. Concur Invoice lets businesses see all supplier spending, improves cash flow predictions, reduces non-compliance, speeds up approvals, and transforms AP team into a savings centre.

Your business will benefit from:

- Greater visibility: Concur Invoice collates all sources of spend, from POS, e-invoices, paper, and emailed invoice as well as supplier networks into a single, user-friendly dashboard.

- AI-driven efficiency and accuracy: Optical character recognition (OCR) technology simplifies capturing invoices by automatically populating a payment request. Your staff only needs to verify the results and add to your company's workflow.

- Standardised processes: Concur Invoice standardises invoice management processes and workflows across locations and business units.

- Improved compliance: Automation means you can be sure policies are followed, approvals are fast, and payments are on time. As a result, you don’t have to worry about costly mistakes, late charges, or even potential fraud.

- Opportunity for growth: With Concur Invoice, you’re bringing accuracy, efficiency, and transparency to AP in a solution that can scale as you grow.

Let’s look at how three organisations have worked with SAP Concur to optimise their AP processes.

Honda NZ: A weight lifted

With nine locations across the North and South Islands of New Zealand, Honda NZ employs 240 people. The spread of offices around the countryside made moving paper around a barrier to efficiency.

What did Honda NZ want to achieve?

Honda NZ sought a sustainable and streamlined invoice process, formerly averaging around 2,500 invoices monthly, which is equivalent to roughly six feet of paper. The existing accounting system required a solution that could integrate seamlessly and support a mobile workforce.

How SAP Concur has helped Honda NZ

SAP Concur was chosen for its compatibility with Honda NZ’s legacy ERP system, and Concur Expense was rolled out before Concur Invoice. The impact of Concur Invoice was huge, and included:

- Better decision-making: Improved spend visibility made renegotiating contracts and data-driven decisions on procurement much easier. “I can now go straight into the SAP Concur platform, pull up that supplier, and I can see twelve months of invoices. For me, that’s a huge saving just in terms of transparency and efficiency,” says Joe.

- Increased cost savings: The elimination of manual document handling led to a decrease in mailing costs and reduced paper storage, saving NZD$17,000 a month.

- Improved supplier relationships: The improvement of approval times from an average of three to four days has had a positive impact on supplier management.

- Enhanced compliance and governance: Built-in authority matrices reduced the risk of fraud and unauthorised spending. “The platform is flexible enough that we can change the authority matrix when we need to align to our existing process. I sleep a lot better at right now,” says Joe.

To learn more about how Concur Invoice helped everyone at Honda NZ sleep better at night, read the case study.

Canaccord Genuity: More get up and go

Investment firm Canaccord Genuity is in the business of making sure its clients get the most out of their investments. But with a global presence across various locations and 900 staff across Canada, managing invoices and expenses was proving to be complex.

What did Canaccord Genuity want to achieve?

Canaccord Genuity needed to modernise its paper-based invoicing and expense management processes to handle a high volume of transactions efficiently. The centralised AP team in Vancouver managed around 100 expense reports and 100 to 200 invoices weekly, creating a significant administrative burden. “Our team is very ‘go, go, go’. We can work through a lot of invoices and expenses one day but the next, it’ll all be back. Today, those approvals and payments go through much faster – typically, under a week”, says Romeeta Bains, Manager, Accounts Payable at Canaccord Genuity

How SAP Concur has helped Canaccord Genuity

- Improved supplier relationships: The transformation led to better vendor relationships, reduced manual work, allowing the AP team to focus on higher-value tasks and strategic analysis. “The AP team is spending more of their time analysing what types of vendors the company is working with and whether there are opportunities to negotiate better rates, to ultimately save on the bottom line”, says Romeeta.

- Employee experience and sustainability: Employees, particularly millennials, appreciated the intuitive app interface and mobile functionality, while the reduced burden of managing physical receipts and paperwork supports sustainability.

To learn more about how Canaccord Genuity transformed its invoice process and boosted sustainability efforts, read the case study.

Ingeus: Seeing the full picture

Ingeus is an employment and health programme which helps people improve their employment, skills and everyday lives. The organisation had no formal purchasing system, instead relying on emails and paper-based processes for AP. The workforce's 500% growth in five years required a scalable solution to handle the increased volume of transactions efficiently.

What did Ingeus want to achieve?

The invoice process had become unmanageable as the workforce grew to 2,500, causing frustration, with employees frequently expressing dissatisfaction. Tracking and approving invoices was time-consuming and error prone. “AP was all very much based on emails and bits of paper flying about. That’s OK when you’re small with just a couple of people in an office, but when you’re 2,500 people strong and handling 3,000 invoices a month it’s hard to keep track. It doesn’t really work”, says Michael Berry, Head of Change Management at Ingeus.

How SAP Concur has helped Ingeus

- Clearer monthly forecasting: Concur Invoice provided the CFO with a clearer picture of the cash position, including insights into upcoming payments and the financial pipeline. “The OCR element of Concur Invoice is fantastic, the best I’ve seen in an invoice processing system. Now we can see what’s in the pipeline and what will need to be paid next month. It’s a great place to be, and a place where every business should be,” says Michael Berry, Head of Change Management at Ingeus.

- Employee experience: In the UK, Ingeus is already redeploying accounts payable staff onto higher-value work.

- Improved compliance: The integrated system ensures all purchases have a digital audit trail, enhancing compliance and transparency and financial management.

To find out more about how Ingeus perfected their AP processes, read the case study.

Seven benefits of end-to-end invoice automation

Small firms need to invest in ease-of-use and upgrade paths; large companies need integration and advanced reporting. As we have learned, with Concur Invoice they get that and much more.

- Speed and accuracy: Using AI, machine learning, and best practices you can eliminate manual steps, correct costly inaccuracies, and improve the pace of approvals and payments.

- Visibility and peace of mind: Guide planning, forecasts, and budgeting decisions across the company – integrating AP and expense report data together to give you an always-on look into your overall financial picture.

- Optimal payment strategies: Frees financial teams to drive business forward; Puts an end to siloed transactions; Increases visibility into spend data; Reduces invoice-processing time.

- Compliance: Manage and control the spend authorisation process; Assists in accurately forecasting budgets; specify goods and service expectations with vendors.

- Centralised, digitised receipts: Outsource the scanning of invoices. Allow your business to remove the human errors caused by entering invoices by hand.

- Improved supplier relationships: Automatic payment of invoices to maximise supplier discounts; flexible payments based on supplier terms.

- Agility: Quickly adapt as spending changes and strengthen control over spending even as your business and regulations evolve – adding new suppliers, new business units, new locations, or more.

Adapt and thrive with Concur Invoice

As the role of CFO continues to evolve, embracing innovation and technology will be key to driving success and ensuring that businesses can adapt to whatever comes next.

If organisations like Honda NZ, Cannacord Genuity, and Ingeus can transform their AP processes, so can you. As we've explored, automating the invoice process is not just a strategic advantage – it's becoming essential for businesses aiming to stay competitive. With solutions like Concur Invoice, you can achieve greater efficiency, visibility, and compliance, all while empowering your teams to focus on higher-value tasks.

By investing in the right tools, you can not only streamline your processes but also position your business for sustainable growth in an unpredictable world.

Learn more about Concur Invoice today.